Competitive analysis is a major part of any comprehensive market analysis. It allows you to gather information about your competitors, assess their strengths and weaknesses and helps you build strategies to improve your competitive advantage.

In a competitive analysis, there are many areas to look at and examine. In this list, we have covered how to do a competitive analysis using several competitive analysis techniques that you can use during each phase of your competitor research and competitive analysis.

A competitive analysis is a central part of a marketing plan. Information gathered from a competitive analysis helps you identify what makes your product or service unique from that of your competitors. Using that data you can develop strategies to attract your target market.

Competitive analysis is the process of identifying and evaluating the strengths and weaknesses of a business’s competitors to understand the marketing landscape and improve one’s strategy. This involves analyzing the competitors' products, pricing, marketing strategies, customer base, and other relevant factors. Businesses can adapt and develop in ways that set them apart from their competitors and appeal to customers in new ways by studying how their competitors operate and what differentiates them. The main objective of a competitive analysis is to identify opportunities and threats within a particular market or industry and to use the information to make informed decisions to gain a competitive edge in the market.

There are several reasons a business would opt to conduct a competitive analysis. They are,

A competitive analysis depends on competitor information about several areas. You can use the following competitor analysis techniques to gather and analyze the different types of data.

Before you start comparing your product to those out there, you need to know who you are competing with. There are several methods you can use to research and identify your competitors.

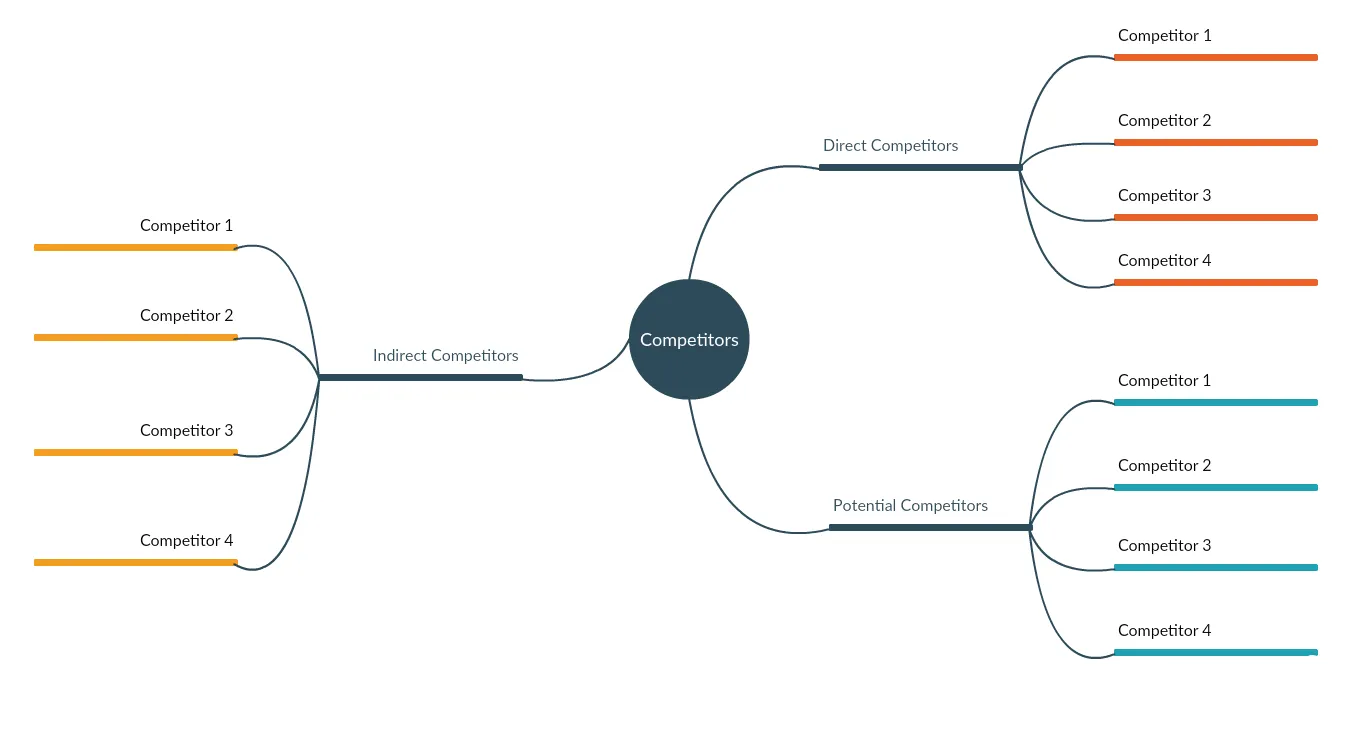

Once your research is done, you may have a pretty long list of the names of direct, indirect, potential etc. competitors.

It’s important to categorize them, so you know which competitors to prioritize. A simple mind map like the one below can help you with that.

You can also categorize them as primary competitors, secondary competitors and tertiary competitors on the mind map.

You can further expand the mind map to include their location, website URLs (click the relevant shape and add link) and other necessary information as well.

More Mind Mapping Templates

Next step is to analyze the competitive landscape. Here you should focus on understanding the strengths and weaknesses or your competitors and threats and opportunities in the industry and find opportunities for growth.

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Use it first to analyze your own product.

Look into what your strengths and weaknesses are. These are your product’s positive attributes like resources, unique product features etc. and negative attributes like inefficient processes, lack of resources etc. These are within your control.

Opportunities are technological advancement, growing market demand etc. And threats could be negative economic and political change. These are external and therefore are out of your control.

You can do a SWOT analysis for your competitors as well to learn how they are surviving in the market.

More SWOT Analysis Diagram Templates

The PEST analysis looks at external factors that affect a product or service. Namely, they are Political factors, Economic factors, Social factors, and Technological factors.

By gathering this information you can determine how your competitors will behave in the face of changes occurring in these areas. You can alter or develop your strategies accordingly.

PESTLE is the extended version of PEST, as it takes Legal and Environmental factors into consideration as well.

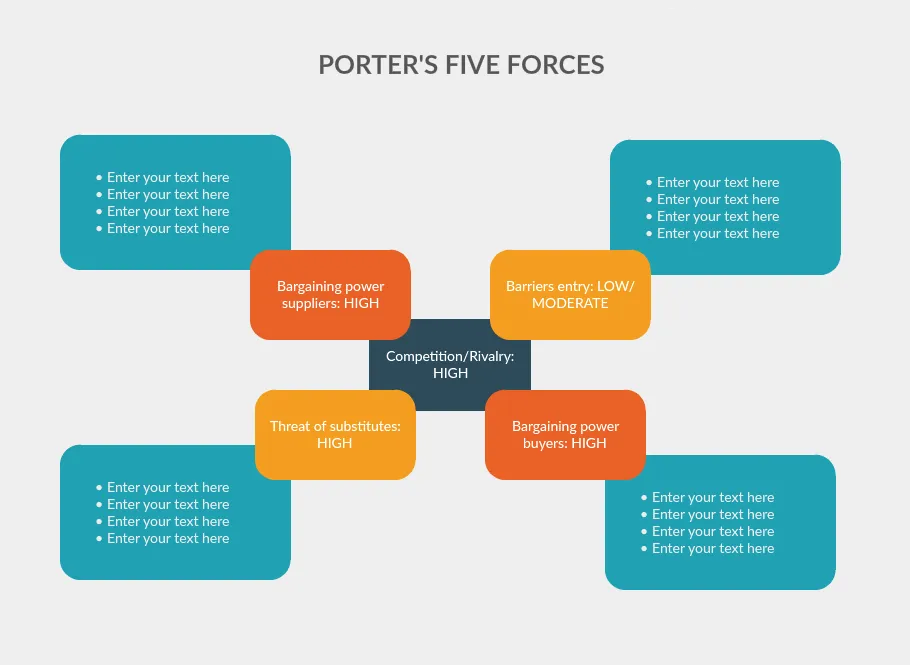

Porter’s five forces analysis examines the environment in which a product operates. It helps to understand the level of competitive intensity in the industry. It primarily examines five factors in the industry

By examining these factors you can determine the profitability and the attractiveness of an industry. Refer to our List of Marketing Strategy Planning Tools to learn how to use Porter’s five forces analysis along with 13 other tools to plan your marketing strategy.

This is where you try to evaluate the ability of your competitors to influence the perception of their consumers (who also belong in your target audience). In other words, here you’ll be looking at how your customers perceive the products of your competitors as well as that of yours.

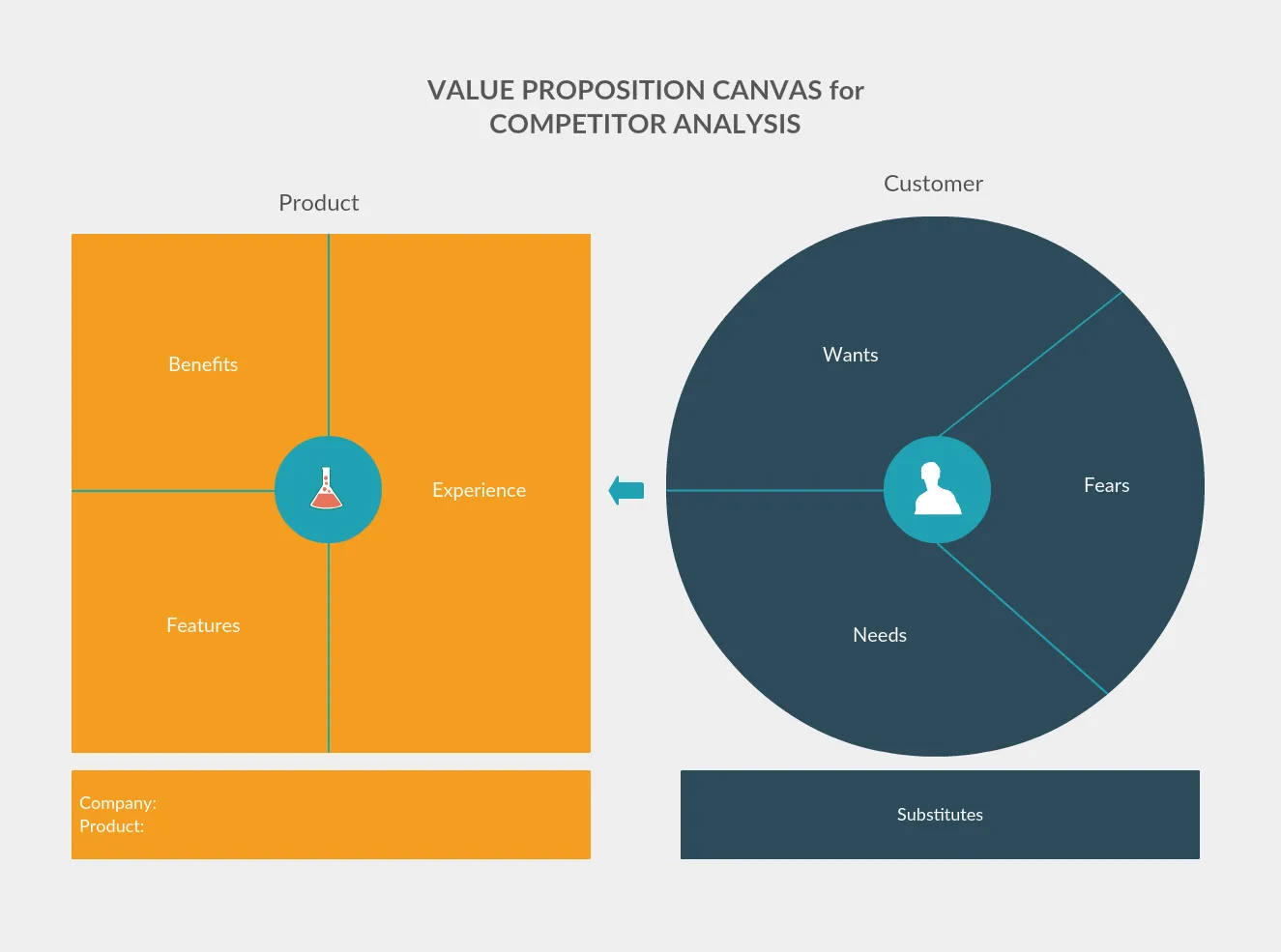

Value proposition canvas is a tool used to develop products that match the needs of customers. It is made up of the customer profile and value proposition of the business.

Customer profile consists of

Value map consists of

Value proposition canvases based on your competitors will help you figure out how they are offering value to their customers.

Refer to our Guide on Launching a New Product to learn how to use the value proposition canvas step-by-step.

The perceptual map helps you identify where your competitors are positioned in relation to your product’s position. It helps you understand what the average target market consumer thinks of your product and those of your competitors.

Step 1: Select two determinant attributes you want to compare your competitors against. These determinants are the attributes consumers depend on to make decisions. For example, it could be the quality of the product and the price of it.

Step 2: Gather your list of competitors in the product category. From the mind map of competitors, you created earlier, pick 5 to 10 players in the first category.

Step 3: Based on a 1 to 5 rating scale, give scores to each selected competitor using the two determinant attributes.

Step 4: Using the grid, assign a place for each competitor. This will help you get a quick overview of where each and every competitor stand compared to one another.

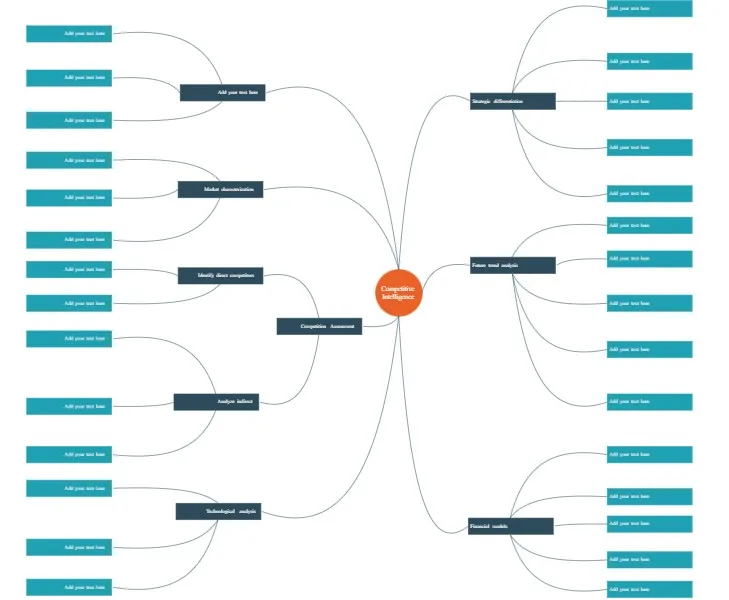

Competitive intelligence analysis is the process of gathering and examining data on competitors, their products and customers, and target markets.

The synthesized data you generate through the analysis can be used by internal sales and marketing teams to make better decisions and develop strategies.

Step 1: Conduct research to gather data on your competitors. You can rely on resources like the customers, websites, social media, analyst reports, press releases, demo videos etc. to find information on your competitors, their customers etc.

Step 2: Use a mind map like the one below to organize and categorize the data you’ve gathered

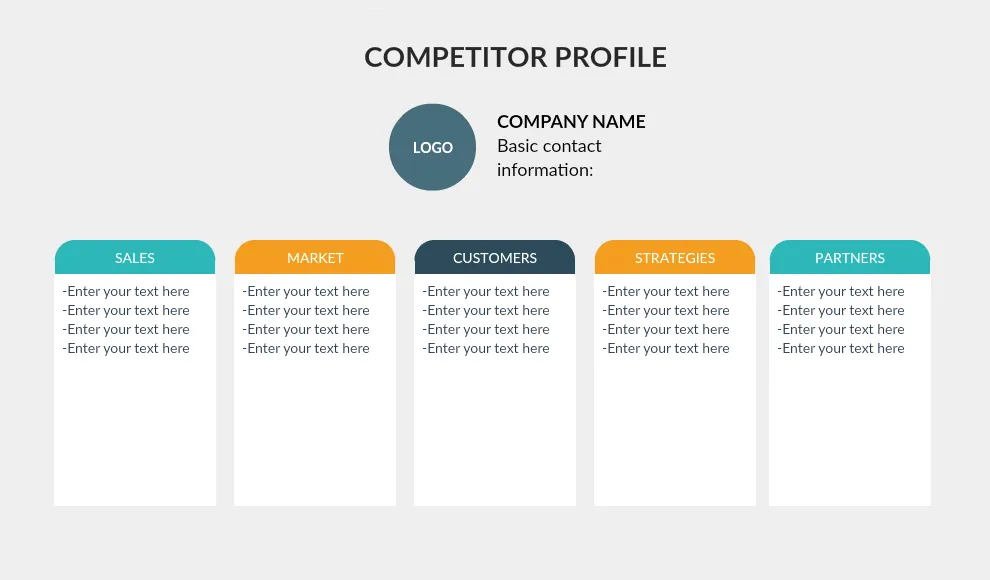

Step 3: Sort through and analyze all the data and create a competitor profile that covers aspects such as products, market, sales, partners, etc.

Step 4: You can use a competitor profile like the one below to organize information and save them for later use and share it with your internal teams that need to come up with strategies to counter your competitors.

When developing new product features or outlining your pricing strategy, you need to take into consideration your competitors and how they have managed to deliver to their customers so far.

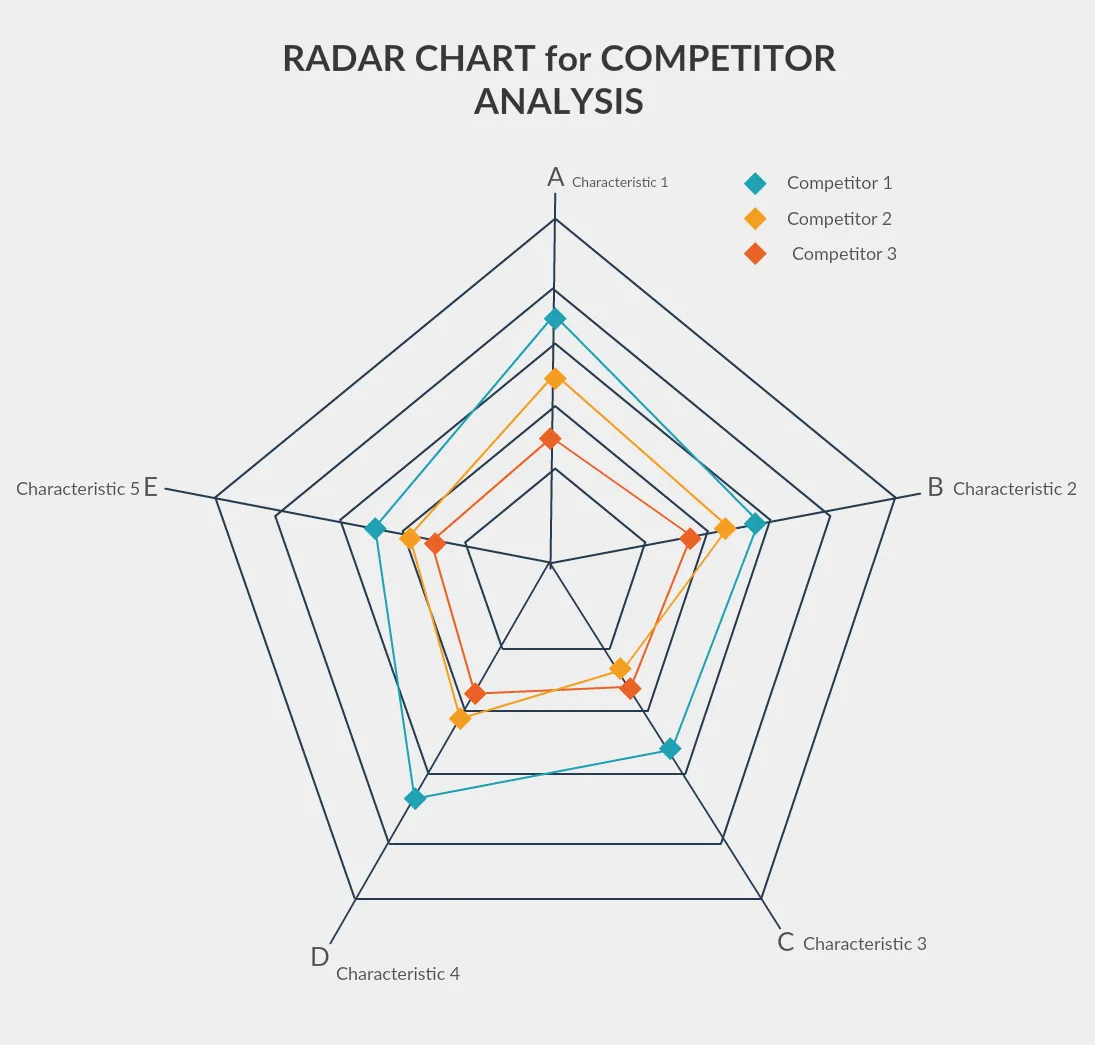

A radar chart is a tool that you can use to compare the products of your competitors based on different characteristics. It will help you identify which competitors are scoring high or low within the characteristics you’ve selected.

Step 1: Select the competitors you want to compare and assign them an axis that starts from the center.

Step 2: You can either select one characteristic and compare several competitors to evaluate their performance, or you can take one competitor and evaluate how they score under several characteristics.

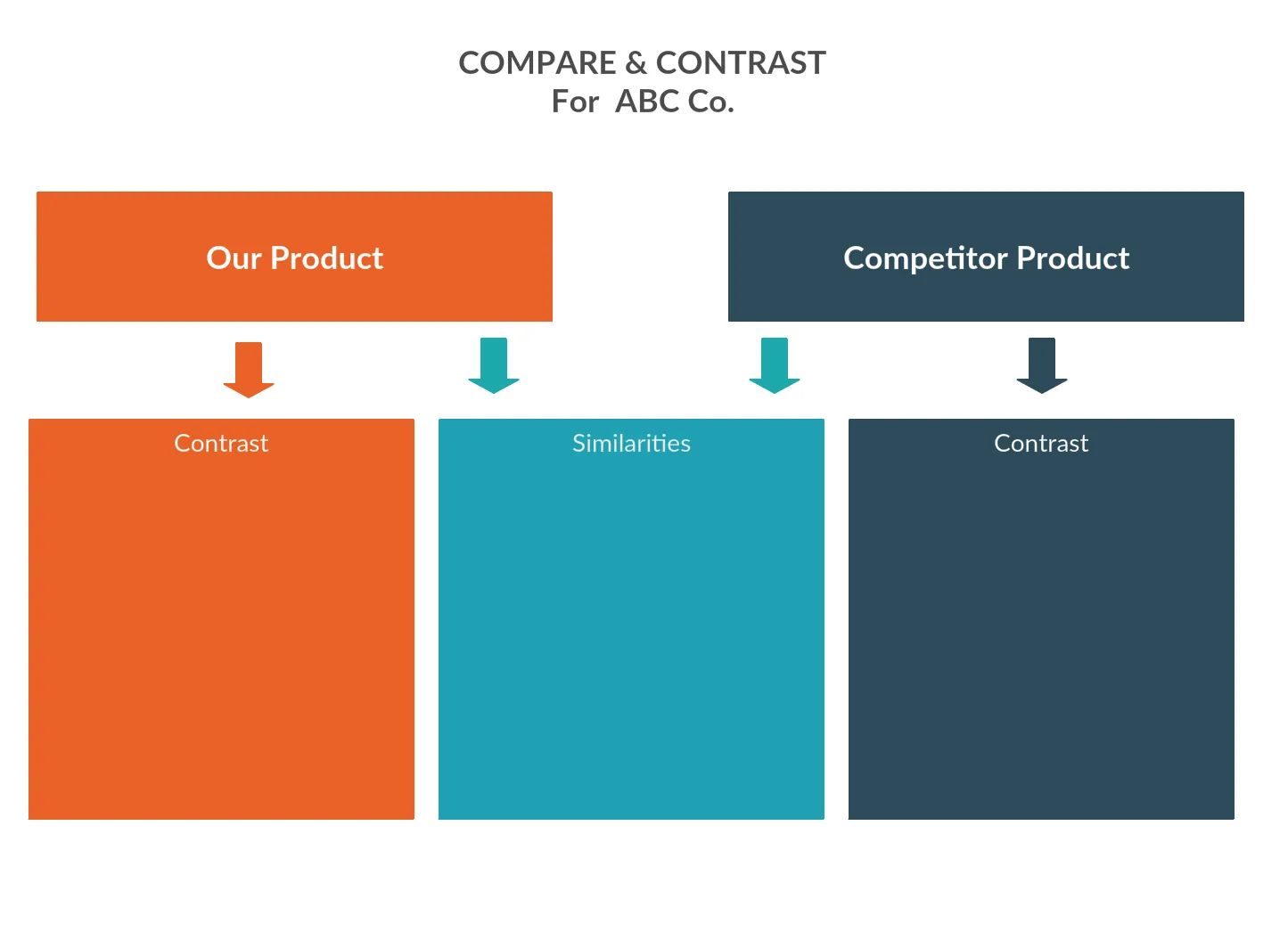

Compare and contrast charts are a great visual tool to compare products. It will offer a quick overview of the capabilities of competitor products and that of yours when you are planning strategies or new developments.

Whether you want to compare product features, prices, or characteristics of competitor marketing strategies, generate compare and contrast chart and it is a great way to organize and analyze information.

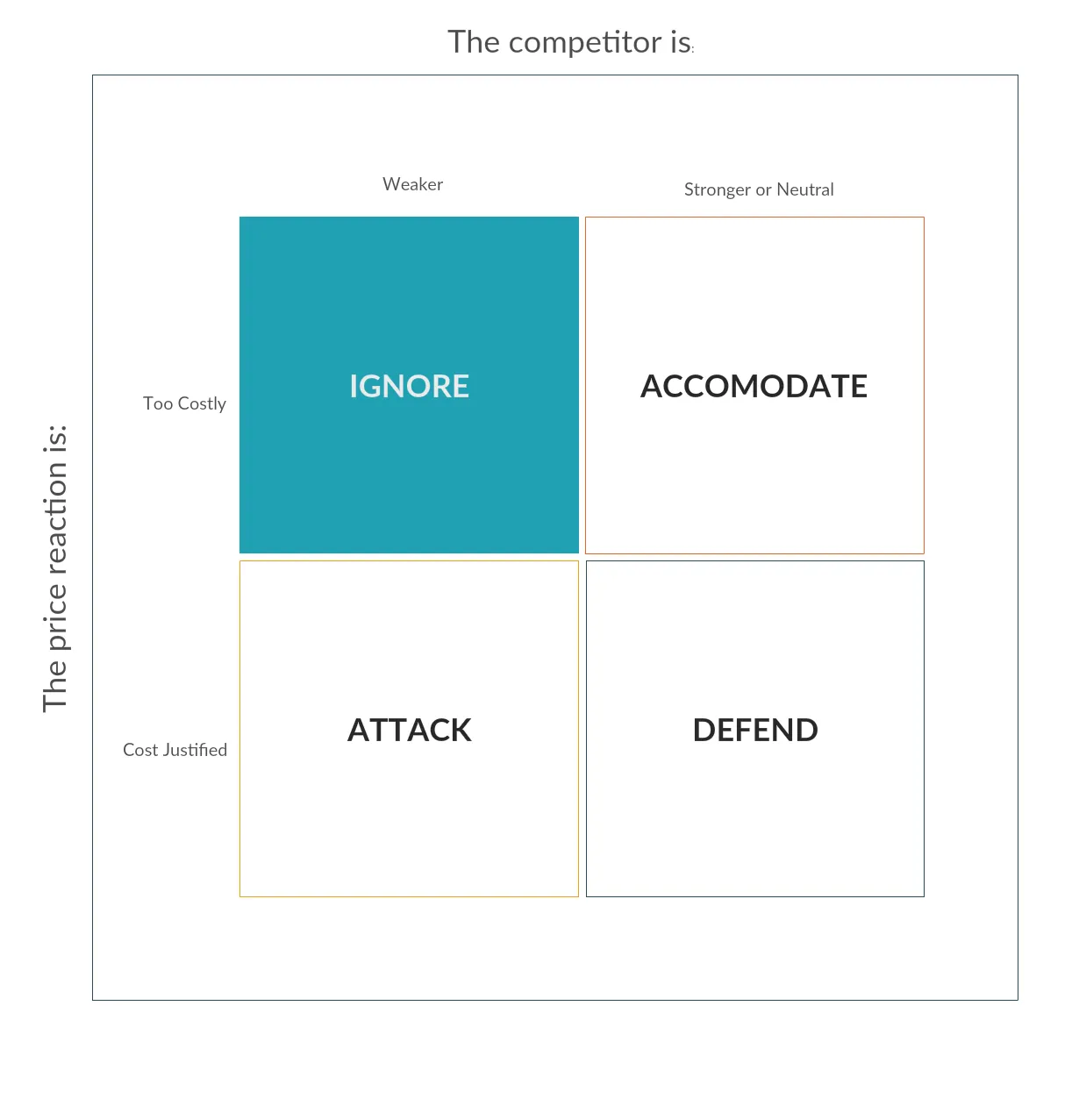

With a chart like the one below, you can rate your competitors based on their strengths and whether increasing or reducing your product price is too costly or profitable for you.

Step 1: Research and gather price information of your top competitors

Step 2: Figure out whether reducing or increasing your product’s price to gain a competitive advantage over your competitors would cost you too much or help you make profits

Step 3: Use the grid below to visualize your findings and find which price reaction you should take in order to make a profit.

Read this article to learn how to use a standard competitive price response analysis in detail.

Try to avoid the below mentioned mistakes when you are conducting a competitive analysis.

Focusing too much on the competition

It’s critical that you remain focused on your own business and not get caught up in what your competitors are doing. It is of course important to understand your competition, but it should not be the only factor influencing your company’s decisions. Rather, a competitive analysis should provide you with insights in the market and actions of your competitors. Make sure to balance your competitive analysis with your own strengths and goals.

Failing to consider indirect competitors

Due to the fact that they provide alternatives or substitutes for your goods or services, indirect competitors can be just as significant as direct ones. Even if they are not direct competitors, make sure you include any relevant competitors in your research.

Relying on inaccurate, outdated or incomplete information

A competitive analysis is only as good as the information it is based on. Make sure you are gathering accurate, up-to-date and complete information from reliable sources. Double-check your data and update your analysis regularly.

Not prioritizing key factors

When conducting a competitive analysis, it is critical to give priority to factors that are most important to your business. For instance, if pricing is an important aspect for your business, make sure you prioritize gathering and analyzing pricing information from your competitors.

Not developing an action plan

A competitive analysis is only useful if you use the insights gained to inform your business decisions. Therefore, make sure to develop an action plan based on the findings of your analysis and to set clear goals and objectives for your business.

Not carrying out keyword research of tracking Google search rank

Keyword research and tracking Google search rank can give you valuable insights into how your competitors are positioning themselves in the market and what keywords they are targeting. Make sure you include this information in your competitive analysis.

Not keeping up to date with industry news or trends

The market can change quickly, so it’s important to stay up to date with industry news and trends. Make sure you regularly check industry publications, news websites and social media for relevant updates.

Not updating the competitive analysis regularly

A competitive analysis is not a one-time event but an ongoing process. Make sure you update your analysis regularly to stay current with changes in the market and your competitors' activities.

Not getting relevant stakeholders involved

Make sure you involve relevant stakeholders, such as marketing, sales, and product development teams, in the analysis process and share the findings with them. This can help to align everyone around a common understanding of the market and competitors, and facilitate collaboration towards shared goals.

In this list, we’ve covered visual techniques that you can use to research competitors, analyze the competitive landscape and competitors’ market position and more.

These visual competitor analysis tools help you organize the data you collect and make effective decisions about how you should position and market your product or service.

Have you got any other competitive analysis techniques to add to the list? Leave your thoughts in the comment section below.

Join over thousands of organizations that use Creately to brainstorm, plan, analyze, and execute their projects successfully.

The insights obtained from a competitive analysis can be used to improve your business strategies and gain a competitive advantage. Use the information to identify strengths and weaknesses in your own business and make necessary changes, opportunities for growth and to adjust your marketing strategies to better position your products or services.

The frequency of conducting or updating a competitive analysis depends on your industry and the rate of change in your market. However, it’s generally recommended to conduct/update a competitive analysis at least once per year or whenever there is a significant change in the market or your competitors' activities.

Consider aspects including pricing, product characteristics, customer service, distribution methods, marketing plans, and brand reputation when analyzing the data gathered during a competition analysis. To evaluate your company’s unique selling proposition and the strengths and weaknesses of your competitors, use tools like SWOT analysis, Porter’s Five Forces, and benchmarking.

The main types of competitors in the market include direct competitors who offer similar products or services, indirect competitors who offer substitutes or alternatives to your products or services, and potential competitors who could enter the market in the future.

Some examples of competitive analysis include analyzing competitor pricing strategies, comparing product features and quality, evaluating marketing and advertising tactics, and monitoring customer feedback and reviews.

Amanda Athuraliya is the communication specialist/content writer at Creately, online diagramming and collaboration tool. She is an avid reader, a budding writer and a passionate researcher who loves to write about all kinds of topics.